Are they for fast cars? A luxury home? Or maybe to graduate

college? What about starting a family? We think of what makes us happy; what we

would like our lives to be like in the distant future. No matter how much or

how little we may have, there is always that thirst to achieve something

greater. While many dream of material things, our borrowers envision the

success of their families and members of their communities. They may have very

little, but they work tirelessly so that their children can have an education

and access to a quality of life that they never had.

Day three brought us to Iloilo,

home to 22 of our Filipino borrowers. Luckily for us, our chaperone, Sister

Cori, was also a native of Iloilo city. She enthusiastically gave us a

first-hand look into to a wide variety of people, cultural sites and historical

monuments.

Day three brought us to Iloilo,

home to 22 of our Filipino borrowers. Luckily for us, our chaperone, Sister

Cori, was also a native of Iloilo city. She enthusiastically gave us a

first-hand look into to a wide variety of people, cultural sites and historical

monuments.

We visited her home and got acquainted with her mother and family.

Beautifully decorated, her home exuded culture, tradition and perseverance. The

walls were lined with pictures of her many siblings, proudly adorned in their

graduation attire. While her father earned his income as a lawyer, her mother

stayed at home and cared for all twelve children. These parents dedicated their

lives to ensuring that their children would flourish – and so they did!

Followed by visits to churches and other cultural beacons,

we travelled to Colegio de San Jose, where our borrowers eagerly awaited us. One

of the major drawbacks of micro-finance is that it is difficult to measure the

impact of the work performed. How do we measure the transformation of the lives

in the communities we offer micro-credit to? How can we be certain that the

services we are providing are truly worthwhile? Those and so many other

questions were answered in a single PowerPoint presentation (Yes, our borrowers

prepared a group presentation worthy of exposure on a college campus!). We were

truly amazed at the progress these borrowers had made with their enterprises

since the approval of their loans in December last year. What began as a mere

idea in 2009 became the GLOBE that we know and love today – a program that is

now evidently uplifting communities and changing lives.

As shown in their presentation, these borrowers transcended

the model of individual entrepreneurship. Castaway on a remote island of

Taloto-an, just off the coast of Iloilo, our borrowers formed cooperatives,

established group enterprises and reaped rewards exceeding our expectations.

They conducted regular meetings and created a natural cohesion that motivated

each business to success. With a limited command of the English language, they

presented their cases with confidence, sprinkling their local dialect in

between to our delight. For example, consider the case of the Sitio Guinmesahan

Store. Have a look at the transformation as a result of GLOBE:

In a joint – cooperative, these borrowers combined their

efforts in order to relocate and improve their store. The store is now

represented by ten cooperative members, who each enjoy a capital share of 500

Philippine Pesos each – a scene reminiscent of what we learn in the Finance

textbooks. Their store now generates approximately 800-1200 Pesos a day and

meetings are regularly conducted by officers to ensure smooth operation of the

micro-enterprise.

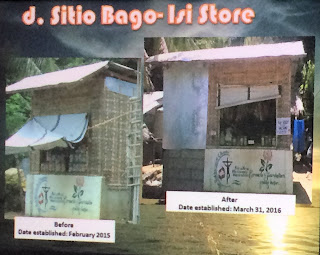

How about the Sitio Bago-Isi store, can you “spot the

difference” between these images?

Like (most) stories we appreciate, this one also comes with

a happy ending. We sat at the Colegio and witnessed the impact of GLOBE being

multiplied within this community. These borrowers managed to find innovative

ways to use the returns from their enterprises to help their communities – just

as they promised to do within their loan applications. They even offered microfinance

services of their own – giving a far greater number of people the means and

hope provided by GLOBE. In one example of a joint loan, totaling, 90,000 Pesos,

the Sari-Sari (Convenience) store was expanded and can now accommodate a

greater variety and volume of items. Considering the long run growth of the

store, the shopkeeper even opted not to have a formal salary, devoting a

greater amount of funds to the business. More importantly, the three borrowers

designated 50,000 Pesos towards their very own micro-finance fund. This fund is

used to provide loan assistance to their 12 cooperative members. Isn’t that

amazing? It appears that GLOBE is spreading within greater communities, serving

an even greater population as if on its own.

At the conclusion of the formal presentation, our meeting

was far from complete. We engaged each other, asking questions, sharing

insights and stimulating discussion. Curious, I asked them, “What are your

dreams? What do you dream about?” At the time, I anticipated responses relating

to having a thriving enterprise, expanding profits, or alleviating poverty for

themselves. Instead, they responded with, “To see my children with a good

education,” “To make sure my family can get out of poverty,” “So that our

children will be happy.” Our borrowers were much more concerned with uplifting

future generations with wise investments that looking after their own benefits.

They were planting seeds – seeds that promise to create successful enterprises,

proud parents and grandparents.

We left the Colegio with a sense of pride and accomplishment.

GLOBE was igniting change in communities in ways we had never imagined. We

could not help but anticipate the next meeting with a great sense of optimism.

No comments:

Post a Comment